Housing Market Predictions For 2026: What Buyers And Sellers Need To Know?

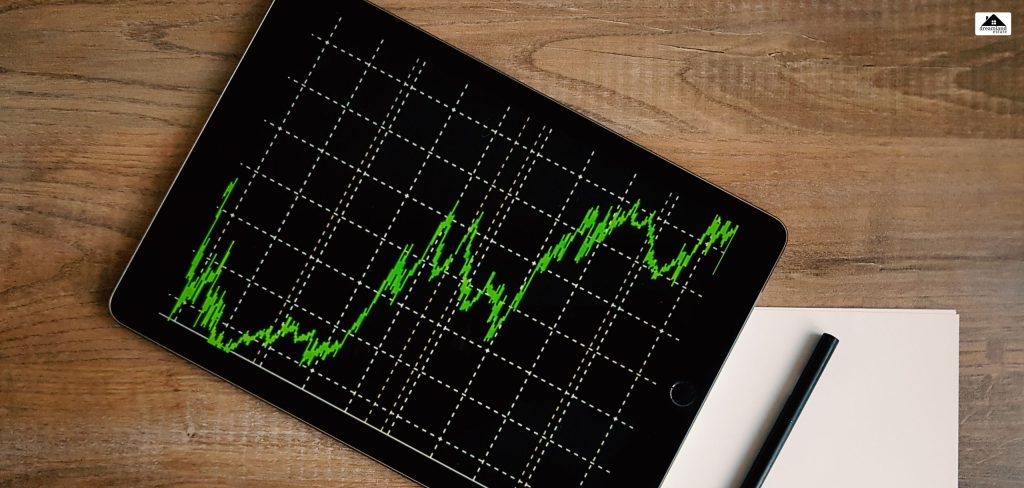

As we head into 2026, the housing market is looking better for those selling their homes. According to Fannie Mae’s Economic and Strategic Research Group, everyone is expecting that home purchases are going to increase significantly.

They are forecasting that by December 2026, a year’s worth of home purchases, known as a sales pace, will total 4.446 million.

This leads to representing a significant improvement compared to approximately 4 million for 2025.

Analysts believe that mortgage rates, which have been slowly falling, will predict rates for a 30-year term to fall below 6% by December 2026.

However, all eyes are on the question of whether it actually occurs. It depends on how financial situations improve during the next year, particularly for normal buyers regarding home expenses.

How Is The Status Of The Current Housing Market Globally?

The global real estate market has remained relatively unchanged. Across the board, home prices have remained stable over the past four quarters, despite the rise in inflation. Why? Demand, being pressured by a lack of affordability, is capping it.

According to the Global Real Estate Bubble Index, some cities are more prone to real estate bubbles than others. For instance:

- Miami is at the head of a record-high risk of bubbles.

- Tokyo and Zurich are hardly behind.

- High-risk locations are also Los Angeles, Geneva, Amsterdam, and Dubai. They recorded the highest increase in risk during the current year as compared to the previous year.

Meanwhile, Madrid experienced the highest real annual price growth. Low-risk markets are considered to be London, Paris, and Milan.

The safer category also includes other cities, such as Hong Kong, New York, and São Paulo. In this category, São Paulo ranks the lowest among all bubble risks.

In a nutshell, neighbourhoods are getting colder, while others are getting warmer. This further highlights how fragmented the global real estate market is becoming.

Here Are The Key Points To Consider Before We Begin!

Fannie Mae’s research arm has released fresh forecasts for the 2026 housing market, which are quite upbeat.

The Economic and Strategic Research Group now projects that total home purchases, both new and resale, will climb by 9.2% by year-end 2026 compared to 2025.

Home sales are expected to reach 4.446 million, representing a 9.6% increase from the end of 2025.

More upbeat for September compared to February are the group’s September 2025 Economic and Housing Outlook forecasts.

They called for a reduced overall increase of 6.1% and a 6.7% gain for existing home sales at that time.

Additionally, mortgage rates are expected to continue increasing. Fannie Mae’s view is that the 30-year fixed mortgage rate should fall to 6.4% by December 2025 and continue to decline to 5.9% by the end of 2026.

The last few years have been tough on buyers and sellers, yet a better day is ahead of us.

What Are The Factors Needed For A Market Resurgence?

The housing market recovery is unlikely to happen anytime soon. That really depends on better finances and whether homes are affordable to buyers.

Odeta Kushi, deputy chief economist at First American, thinks modest improvement is possible in 2026.

Variables such as additional homes available for sale, slowing home appreciation, and less aggressive mortgage rates should stimulate home purchases to rise cautiously.

She also cites our lifestyle choices, which we also refer to as the “five D’s” (diplomas, diapers, divorce, downsizing, and death), as factors that will continue to influence buying and selling decisions about houses, regardless of how the market is faring.

For real estate agents, the last few years have been tough. The previous time existing home sales were near 4.5 million was in October 2022.

Since then, there have been many months where the number went below 4 million — a clear sign of how slow the market has been.

However, if predictions are correct, 2026 may yet mark the slow start of a turnaround.

It Is Getting A Little Difficult For First-Time Buyers!

Affordability is one of the biggest challenges of today’s real estate, especially for first-time home buyers.

Experts predict home resales are going to reach a 30-year low in 2025, largely because so many homes are far too pricey for buyers to afford.

The First American First-Time Home Buyer Report (September 2025) reports that a mere 26% of homes were affordable for the typical renter during the second quarter of 2025. This is a modest decline compared to 28% in late 2024.

The report also tested affordability in a novel manner: examining NFL divisions.

The AFC South, including Jacksonville, Indianapolis, Houston, and Nashville, experienced the cheapest houses. Here, there are affordable houses for 26% of the homes available for average renters.

The NFC West, which includes Los Angeles, Seattle, San Francisco, and Phoenix, was also at the end of the tail. Only 8% of homes there are affordable for an average renter.

That’s a large spread, indicating how where you live still impacts probabilities in the real estate market.

Warning Signs That Things Are Getting Better!

The good news? It’s getting better for affordability. The mortgage interest rates have decreased of late, wages are increasing, and home prices are not going up as fast.

Mark Fleming, chief economist of First American, boiled it down best, saying that all things are more stable, income is increasing, and prices are not increasing as far! All of those are signs that it’s less scary to buy.

This mix might be accountable for that revival, which experts like Fannie Mae are forecasting for 2026.

If the trend holds, prospective buyers waiting on the sidelines might find 2026 to be a good year to buy into a market, particularly as interest rates for mortgages fall below 6% and more homes come onto the market.

Leave A Reply