Most Purchase Agreements Are Contingent On Which Two Items? (Updated 2024)

The contingent term in the real estate purchase agreements is that the home seller accepts the buyer’s contracts. And they agree with the terms and the conditions of the home. When the buyer is proceeds to purchase the new real estate property, not only the economic terms, the buyers have to fulfill many terms and conditions of the sellers of the purchase agreements.

Most purchase agreements are contingent on which two items? And what types of purchase agreements are contingent on? Let’s have a look at what contingent means in the real estate business.

What Is Contingent Meaning In Real Estate?

When do you want to know most purchase agreements are contingent on which two items? You have first to know which types of things are counted as contingent in the real estate business. Contingent factors can vary from the financial terms to the other terms depending on the agreements before processing the buying and the selling. Real estate agreements are available for different terms and conditions.

From the start, the seller is going to need financial security so they can restrict and limit the money of the installments. Along with the financial issues there, many other factors are also affecting real estate. Agreements. So when the buyers and the sellers of the real estate property are settling upon an issue. And finalize the deal, they are more often focusing on the two basic types of contingent factors for better results and clear dealings.

So let’s see most purchase agreements are contingent on which two items during the real estate property purchase deals.

What Are The Most Common Contingencies Visible In Purchases Agreements?

Home buyers are usually concerned about different contingencies when they are buying a home. There are different financing contingencies they can choose from. There are many house buyers who buy the house only to find out different funding or financing-related problems after the purchase is made.

Some smart buyers also often include an inspection contingency clause to keep their investment protected. Also, some of the buyers also consider a mortgage contingency where they ensure that they have the amount they need to pay for the mortgage for the house.

So, if we are talking about the most common contingencies at the time of purchasing a house, then two of them would be –

- inspection contingency clause

- And mortgage contingency.

It allows the house buyers to ensure that the purchase they are saving so much money for does not go wrong. These processes ensure that the house-buying process goes as smoothly as the house buyer had initially thought of.

Most Purchase Agreements Are Contingent On Which Two Items?

Most of the real estate dealings and property purchases are often depending upon the two types of contingencies.

- Financial Contingency

- Inspection Contingency

1. Financial Contingency :

Financial contingency is one of the answers for most purchase agreements that are contingent on which two items? Here is the financing contingency. The seller is offering loans to the buyers who are interested in their property. The seller is always asking for a secure payment system for the property purchase. And for these, the seller is offering a financial contingency.

For example, when the sellers are offering the financial contingency, they write down the property buy offer with two types of data: the address and the price of the property, along with the available financial contingency factor.

As we told you before, in the financing contingency, the seller is playing the role of the loan provider. The buyers, not every time, can get a loan from the bank or professional lenders. Often the buyers depend upon the financial contingency. The seller is offering the loan and making a signed agreement with the buyers. In the agreements, the property price and loan durations are clearly mentioned.

The Pros Of Financial Contingency:

Financial contingency is not for the sellers but for the buyers. This factor is significant.

Here are a few advantages of the financial contingency on the purchase agreements.

- Economic security. Most of the sellers who are offering the buyers the financial contingency plannings are going for less interest.

- The loan period is long and stable.

- The financial contingency agreement papers are not made upon the total cost of the property. The down payment is subtracted from the property prices. So automatically, the interest is not higher like the bank and the private lender’s interest amount.

The Cons Of The Financial Contingency

When you want to know about the most purchase agreements are contingent on which two items? Financial contingency planning is good, but every planning and process has some disadvantages.

- Even financial contingency has a great concept as it provides financial security on both ends. But eviction chances are always there. It is entirely dependent upon the agreements.

- The time is long. This long period is sometimes proved to be not very profitable for the sellers as they are expecting the total amount down payments.

2. Inspection Contingency

The inspection contingency is the second answer for most purchase agreements are contingent on which two items? The inspection contingency is another contingent factor.

Here the professional security checking officer is checking the security factors of the house. This is not a single-day inspection. Almost within seven to ten days, the security concerning officers is checking the security aspects of the house. Between this duration, if any problem can occur or the security concerning officers are not satisfied with the property stability and the structure. The property agreements can be canceled during this time.

The inspection contingency is mainly concentrating on the building material, house design, and building stability. If the security concerning officers is sending the green signals, then only the agreement is going to proceed.

The Pros Of Inspection Contingency

The pros of inspection contingency are when you are buying a new property, more or less, you do not know anything about it. But when you are proceeding after the inspection, your ideas about the house are becoming apparent.

- After the inspection, unusually building structural crisis occurring chances for the real estate property is limited.

- The buyer is getting the full assurances and the entire building structural ideas. In addition, these ideas are helping the buyers in the after-purchase property maintenance.

- If you are buying the property with the furniture, you will know if it is worth it or not; after the inspections. And prevent you from making the wrong decisions over the property purchase.

The Cons Of Inspection Contingency

The inspection contingency is always protecting the buyer from buying any racked house and unnecessary junkies.

- For the protection of the buyers, the inspections are quite an essential part of the agreements.

- After the cancellations, the seller has to publish another form of agreement to proceed with the property purchase. And this is all starting from the beginning.

- After the cancellation, if the buyer is interested in going for the deal with less money, this is merely possible when the sellers are prepared to make another property agreement. So the process is becoming lengthy.

What Are Some Other Contingencies?

Aside from the two different contingencies discussed here, there are other contingencies that you need to know about. Here are two more different contingencies you need to know about.

Home Sale Contingency

Home sale contingency lets the buyer purchase their house contingent on the existing property selling. This type of contingency can create difficulty for the seller. Hence they are often rejected by the seller.

Basically, it is easier to sell your home before you buy another property. However, in most cases, you will find that the timing and finances are not working out properly.

According to Investopedia, “A home sale contingency gives the buyer a specified amount of time to sell and settle their existing home so as to be able to finance the new one. This type of contingency protects buyers because if an existing home doesn’t sell for at least the asking price, the buyer can back out of the contract without legal consequences.”

Nevertheless, a home sale contingency can be quite difficult for the seller. This is because, in such situations, the seller passes up another offer out of compulsion while waiting for the contingency outcome. Here, the seller has the right to cancel the contract even if the buyer’s home is not sold within a given time period.

Appraisal Contingency

There is an appraisal contingency that says that the property needs to appraise for a sale price at least. However, if the appraisal comes in lower than the agreed-upon term on the real estate contract, the buyer can terminate the sale.

The appraisal price is generally very common in the buyer’s market. When the real estate market favours the buyer, the buyer would normally waive the appraisal. They can also propose appraisal gap coverage.

Kick-Out Clause

Sellers add the kick-out clause as a contingency so as to keep a measure of protection against a situation of house sale contingency. Here, the seller of the property agrees on the house sale contingency. However, the seller can also add a kick-out clause to it by stating that the seller will be able to continue to market the property.

On the other hand, if another buyer (one who qualifies) steps up, the current buyer gets a specific time duration from the seller. This helps in removing the house sale contingency and ensuring that the contract is alive. If this does not happen, the seller can back out of the contract and sell the property to the new buyer.

Contingencies in Real Estate

According to BankRate.com, “In real estate, a contingency refers to a clause in a purchase agreement specifying an action or requirement that must be met for the contract to become legally binding. Both the buyer and seller must agree to the terms of each contingency and sign the contract before it becomes binding.”

Basically, if a contract becomes contingent, both the parties (buyer and seller) get room to save themselves. This helps a lot when they fail to meet the legal and regulatory conditions of real estate. The buyers and sellers of a property can thus be able to cancel their contract if they do not meet the terms of the agreement.

For example, consider a contingent situation as one where both parties need to wrap up other real estate transactions since they want a particular transaction to close.

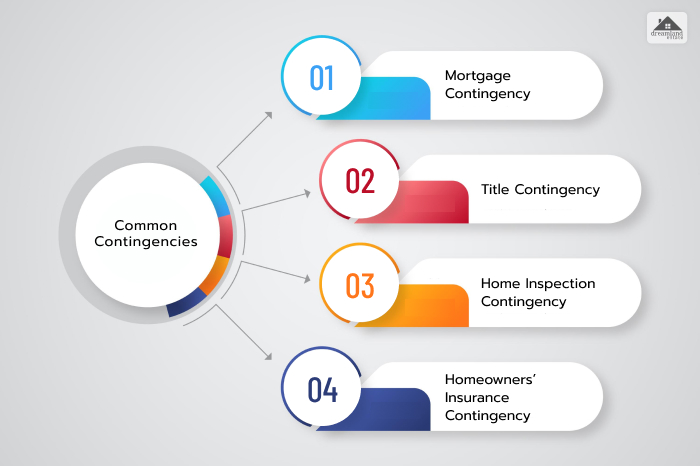

What Are Some Common Contingencies?

The following are some of the most common contingencies that one can add to a real estate contract:

1. Mortgage Contingency

As per this method, the buyer of a property gets a window of time within which they have to obtain their financing if they want to buy their home. However, if the buyer does not secure the mortgage loan or fails to secure one within the time frame, they have the chance to withdraw from the deal. If they do so, they will not have to pay the penalty. Furthermore, this also gives the seller the chance to put their home back on the market and get a different buyer.

2. Title Contingency

Here, the buyer of the property gets the right to have a title search. Furthermore, they can also raise objections to the property title. In the latter case, the seller must clear the title so that they can close the deal faster.

3. Home Inspection Contingency

This offers a time to the buyer within which the buyer will need to ensure the inspection of the property. Basically, this inspection ensures that there are no serious issues with the property. If the property has issues and the seller does not repair them, the buyer can terminate the contract.

4. Homeowners’ Insurance Contingency

The appraisal contingency provides the buyer with the safeguard that the property must appraise for the indicated sales price. Here, it must meet a minimum sales price, or the contract must be nullified. This is because, banks also do not like to loan money to those borrowers for houses that cost more than they are worth.

Making a Contingent Offer to Buy a Real Estate

You can only make a contingent offer on real estate once you make a thorough inspection of the following processes:

- Check the steps during the mortgage process

- Check the appraisal

- Ensure home inspection and underwriting

Apart from that, while you make an offer for the property, you can also include contingencies in your offer.

According to NerdWallet, “A purchase contract is legally binding, and breaking one can be costly. Making a contingent offer protects your interests in case unexpected issues mean you no longer can or want to buy the home. A contingent offer includes “walk-away” clauses, or “contingencies,” that let you get out of the deal and retrieve your earnest money deposit if certain conditions aren’t met.”

Basically, a contingent situation works like an “if-then” situation. For example, you can say that if the appraisal value of the property is lower than the purchase price of the property, then you might ask for a lower price for the property. Otherwise, you will have the right to get out of the contract.

However, you will need to work with a real estate agent when you are writing your offer for the contingency. Here, you will need to divide which contingencies you want to include in the offer and why. Furthermore, you must also ask for explanations from the real estate agent for the options that you choose. Apart from that, you can also look for more recommendations to include in the offer from the agent.

In addition to all these, always remember that real estate contingencies primarily protect your interests. Furthermore, you must also be aware that if there are too many stipulations in the contract, it will reduce your likelihood of getting your hands on the property. In such cases, the seller might not accept your offer.

What Are Contingency Deadlines and Why Do They Matter?

There are deadlines with each contingency. You can learn this with the help of an example. Let’s say there is a home inspection contingency that states a time frame for an inspection.

As per the time frame, the buyer gets a certain number of days within which he/she can ask the seller to make repairs or lower the sales price. If the timeline is over, the buyer cannot ask.

Hence, as a buyer, you will need to make sure that you are keeping track of the contingency deadlines. This will ensure that you miss nothing in the process. Also, you can give a condition to the seller that the latter has to meet within the given frame of time.

One of the best ways to ensure this is to have a calendar for the entire process, which contains all the deadlines. You can also consider keeping pre-deadline notices, which will allow you to deal with critical contingencies better.

Again, one of the best ways to ensure that you stay on deadline is to take the help of a real estate agent. The agent will be able to guide you if the process is more complicated. Furthermore, you can also take the advice of a real estate attorney who can give you recommendations in legal matters related to the contingency.

What are the Major Risks and Challenges of Contingencies?

The greatest risk of using contingencies in your offer is that the seller of the property might not accept the offer. On the other hand, the seller might be too restrictive to allow you to back out of the clause. Apart from that, although your offer might be competitive with other offers, it is better to consult an experienced real estate agent to determine your contingencies.

Additionally, in some top-performing housing markets, some buyers are considering keeping out of contingencies when they are coming up with offers.

This is because they want sellers to accept their offers faster. However, this process is still a risky option for many. This is because the buyers will have to bring cash to split the difference if the property does not get a lot of appraisals.

Apart from that, there are certain challenges of contingencies, too. For example, if the home inspection does not happen within the home inspection contingency deadline, the buyer needs to decide whether to move forward before the home inspection or extend the deadline. Here, if the seller of the property wants to complete the sale within time, then contingency deadlines can make big changes in plans.

Wrapping It Up:

Financial Contingency and Inspection Contingency are the two answers to “most purchase agreements are contingent on which two items?” If you are planning to go for the real estate property sale or the buy, you have to process through these two phases. So how are you planning to process your property agreement? Do not forget to share your opinion in the comment sections.

Read Also:

Leave A Reply