Detailed Guide on Active with Contingency for New Property Owners

Being a new property owner can be quite a hassle and a challenging task, to say the least. Thanks to the internet, browsing and finding the right property has become much easier. However, some aspects require attention. One of them is the term, ‘active with contingency.’

Anybody who has spent some time hunting houses will be familiar with the term. However, there is confusion regarding its meaning. This article will deal with that. Here, we will examine the term and explore its variants. Therefore, let us dive right in and look at the term and the meaning it entails.

Understanding Active Contingent Status

Buying a house is very different from making any other form of investment. There are complex nuances that play a crucial role in the deal’s success. Active with contingency is one such nuance.

Active contingent status entails that the seller and the buyer have agreed to certain terms. However, there are aspects that the duo has yet to discuss. These contingencies are important because they need to be addressed before the sale is finalized.

Therefore, the contingent clause claims that a sale is not yet through but is going on. Hence, the property is technically on the market and has buyers lining up.

How Is It Different from Other Listing Statuses

The real estate industry is highly technical, to say the least. As a result, there are several jargons that a person needs to understand. However, these jargon terms differ from each other, so they need to be understood carefully.

Active with contingency status is not the only listing status in the real estate market. In fact, there are different forms of listing statuses that are active in the real estate market. One of the most common listing statuses is the active listing status. Active listing status means that a property is on the market and that sellers are taking buyer inquiries.

Under Contract is similar to active with contingency. Under contract status, it indicates that the buyer and seller have agreed to the terms, and a contract has been drafted. However, some terms are yet to be clarified.

The most complicated status to understand is the pending status. This is significantly further than the ‘under contract’ status. The awaiting status occurs when part of the transaction process is complete, but the confirmation has not yet arrived.

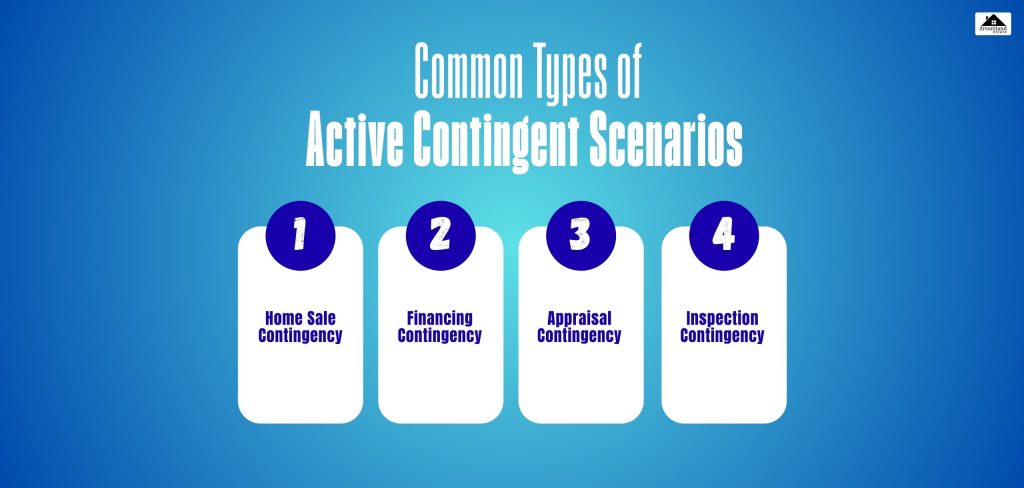

Common Types of Active Contingent Scenarios

Active contingent status is actually an umbrella term. In other words, there are other versions as well. Here are some of the most prominent forms of active contingent scenarios that one must understand.

Therefore, follow along to know more about the different kinds of active contingent scenarios that you could encounter. Hence, let us take the time to explore all the various forms of active contingent scenarios.

Home Sale Contingency

The first option we would like to discuss is the Home Sale Contingency. This is one of the more common home sale contingencies out there. This comes in different variants: sale and settlement contingencies. Both of these variants are wildly different from each other.

The first variant is relevant when the buyer has not yet accepted the offer on their current home. Meanwhile, the latter occurs when the house is sold, but the sale is still under contract. Therefore, a home sale contingency is definitely one of the important and common ones you will encounter.

Financing Contingency

Financing or mortgage contingency is exactly as it sounds. This is nuanced, but it is also one of the more common ones. In many cases, buyers tend to secure the contract for a house. However, they fail to secure the financing.

Typically, the financing contingency time frame is between 30 and 60 days in most cases. This is a standard practice followed by almost all financing organizations. However, the timeframe is entirely dependent on the seller.

In any case, the buyer or the seller can exit the agreement within that period. This means a housing deal is not closed till the names have been transferred. Many people believe that financing is essential for new buyers. This is not the case. Around 80% of buyers tend to use financing as their primary means of buying a house.

Appraisal Contingency

Appraisal contingency is another contingency that buyers and sellers need to understand. In properties with appraisal contingency, a buyer has the freedom to back out at any point. In other words, a buyer can back out if they feel that the property has failed to meet the appraisal requirements.

Home appraisals change the overall value of a home. Therefore, taking out a mortgage is another complicated nuance to consider. Thus, in case a property fails to appraise, buyers can actually back out of the deal legally.

Inspection Contingency

Inspection contingency is most important for pre-owned properties. This means buyers can back out of a deal if they feel that the property is damaged. In case of an inspection contingency, a buyer can hire an inspector within seven days.

Apart from that, the entire inspection needs to be a four-point inspection and must look at major components, including the HVAC, plumbing, roofing, and electrical systems. These components are important and must be addressed.

Experts typically conduct an inspection contingency that includes various detailed points. If the buyer agrees with the repairs, the seller still needs to have them completed before the time frame ends.

Implications For Sellers & Buyers

Contingencies in real estate deals are not just fads that experts use to sound relevant. They are real and have tremendous implications. The reason is that they protect the buyers and the sellers alike. Property sales are generally absolute. Therefore, contingencies ensure that there is a fallback strategy in place.

Active with contingency work, like safety nets, that reduce the risk of financial ruin or problems in the long run. Even though this diligence is there to protect clients, you need to be careful before committing anything financially.

Leave A Reply